Five or six years ago, drones were all the rage among radio control device enthusiasts. The Washington Post reported in 2016 that drone sales were soaring at Christmas, fueling the end of a record year for the popular flying machines. While drones are now mainstays for the military, in certain commercial endeavors, and for film productions that need to leverage aerial views, the fervor for drones in the consumer market appears to have died down somewhat.

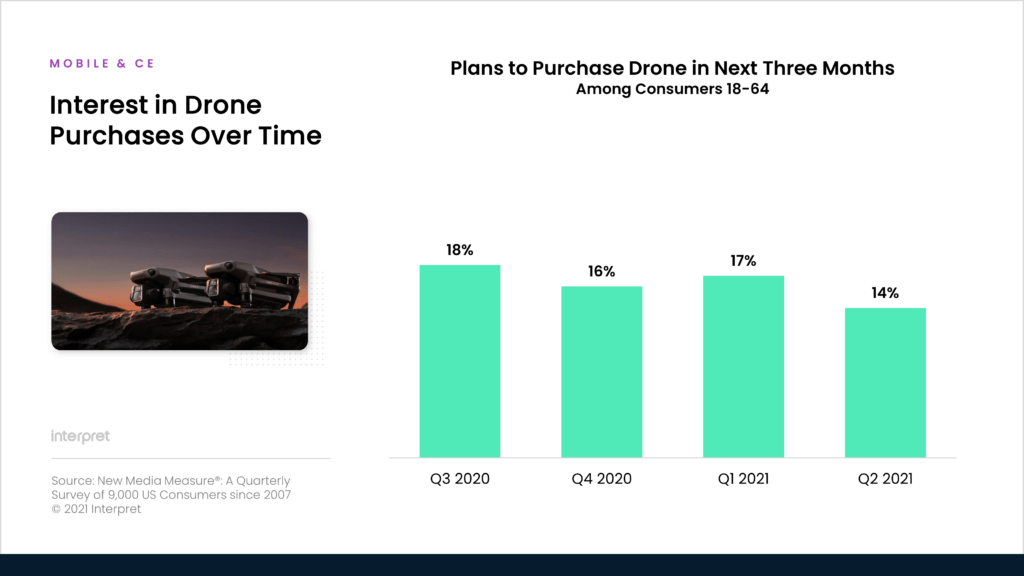

There are no mainstream news outlets writing about drones as this holiday’s hot ticket item. Moreover, according to Interpret’s New Media Measure®, there’s been a noticeable dip in purchase intent among US consumers, age 18-64. A year ago, at this time, nearly a fifth of consumers was in the market to buy a new drone in the next three months, but that figure fell to 16% at the start of 2021 and is now down to just 14% of shoppers age 18+.

As the retail sector gears up for the holiday sales season, drones will still be a technology that some consumers crave. Interpret data reveals that drones are especially popular among men over the age of 35 compared to women. A quarter of men over 35 intend to purchase one in the next three months, whereas only 14% of women over 35 indicate purchase intent. Black Friday and other holiday sales events are likely to benefit drone manufacturer DJI, which controls a majority of the market. The company is expected to release its new Mavic 3 drone in the near future.

There are some clear headwinds for drones to navigate, however. Senior Republican commissioner at the Federal Communications Commission (FCC), Brendan Carr, recently called for a ban on DJI drone sales in the US, likening the threat of the Chinese company to that of telecom giant Huawei. The Federal Aviation Administration (FAA) also implemented stricter rules for drones in the US earlier this year, requiring remote ID and registration for drones over a certain size/weight.

The future remains incredibly bright for drone technology, but the biggest successes are likely to come from enterprise, agriculture, and armed forces. Goldman Sachs believes that the entire drone market currently represents a $100 billion market opportunity.