With the Chinese government continuing to crack down on gaming – following a nine-month ban on approvals last year, Beijing now approves only a small number of new titles – the industry suffered its first contraction in 14 years during the summer, and the nation’s biggest game companies are understandably looking elsewhere to grow their businesses. Tencent, the world’s largest game publisher (not just China’s), also felt the pinch as it recorded its first-ever quarterly loss in August.

To offset the domestic challenge to its bottom line, Tencent is putting more emphasis on making majority investments in Western gaming and metaverse-related firms, according to a Reuters report released in early October. Of course, this is not an entirely new strategy, as Tencent already has spent years acquiring partial or majority stakes in some of the most successful Western gaming companies in the industry, including Riot Games, Epic Games, Supercell, Funcom, Turtle Rock Studios, and more. During its earnings call in August, Tencent emphasized that it’s going to “continue to be very active in terms of acquiring new game studios outside China.”

In September, Tencent became the biggest shareholder in French publisher Ubisoft (Assassin’s Creed), securing 11% of the firm (which can be increased to 17% in the future). Tencent rival NetEase has also begun pursuing Western game companies, acquiring French studio Quantic Dream around the same time that Tencent invested in Ubisoft. However, whereas Tencent seeks to expand through investment without much change to the recipient, NetEase is looking to build more internal development and research capabilities – Quantic is NetEase’s first European studio. And the third Chinese juggernaut looking overseas is TikTok parent ByteDance, which has previously stated that it’s aiming to rival companies like Nintendo and Blizzard.

For any game companies seeking to capitalize on the vast gaming population China offers, not only must they compete with the abovementioned trifecta of gaming/tech superpowers, but Beijing’s restrictions have made it harder than ever for overseas firms to gain entry. That said, there is certainly an opportunity for those with the right market knowledge to help others publish in China, which is exactly what newly launched Singapore-based indie publisher Spiral Up Games is aiming for. The company labels itself as a “gateway to the huge Chinese market,” and promises to “to expose your game to China and increase your revenues exponentially.”

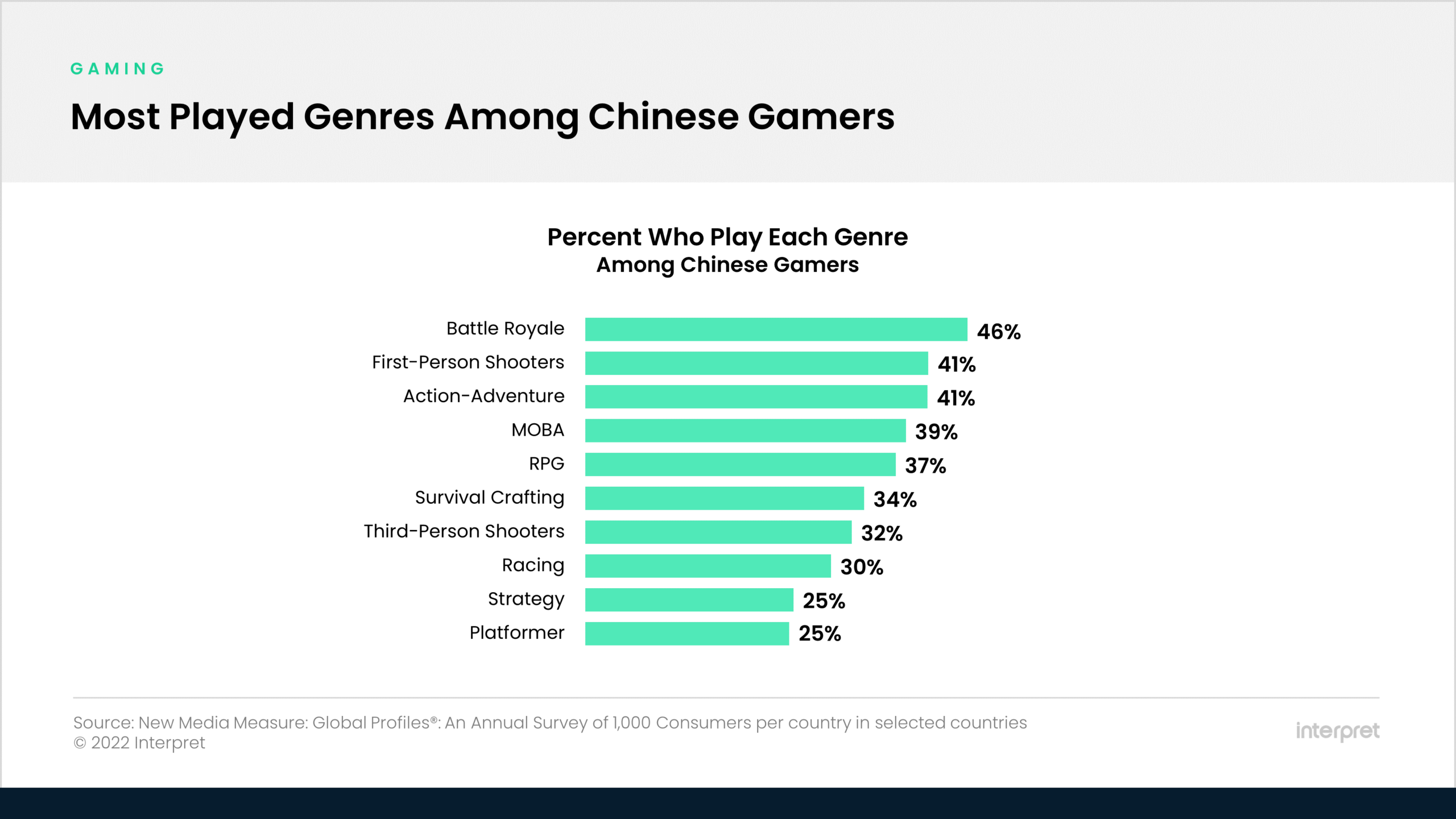

Spiral Up is planning to release three games next year, two of which are RPGs. The genre is among the top five most popular with Chinese gamers, according to Interpret’s New Media Measure: Global Profiles™, but behind others that Tencent excels at like MOBAs, shooters, and battle royales. These are genres that remain popular globally as well, which is something that no doubt will remain top of mind for China’s gaming leaders until Beijing changes its tune.

Ready to level up your career? Check out Interpret’s Careers page for current openings and join our squad of Fun Scientists!