Years from now, there will no doubt be papers written on the lasting impact of the COVID-19 pandemic on consumer behavior. Consumer psychology continues to shift, and marketers have to be two steps ahead. One clear trend to emerge since the start of the outbreak has been a surge in people reevaluating their health and fitness. These consumers have been purchasing more smartwatches or fitness trackers and have been generally focused on improving their diet and exercise routines.

This has been great news for brands targeting health-conscious consumers. Plant-based meat substitutes such as Beyond Burger and Impossible Burger have gone mainstream and even partnered with fast food chains like Burger King and McDonald’s. Impossible recently launched its own food shop and delivery service. In the UK, leading coffee chain Starbucks is dropping its vegan milk substitute upcharge for its beverages, making them price-friendlier options for consumers who want or need to avoid dairy.

For major snack brands, which generally are seen as more processed and less healthy, the health trend presents a different challenge, but the pandemic has given these brands an opportunity as well, as many consumers have sought to alleviate stress through snacking.

As Robert Moskow of investment bank Credit Suisse explained to Adweek, “Big food brands have benefited the last couple of years from people seeking out comfort food, more indulgent snacks—things that give them an emotional benefit. So, you have contradictory impulses from consumers where they want to eat healthier, but they also want something that’s going to ease the stress of living during a pandemic.” Janda Lukin, CMO of Campbell Soup Company’s snacks division, believes consumers want the best of both worlds, as they “want to indulge, but they are also looking for things that are better for you.”

The fitness industry has benefitted enormously as well. While gyms initially suffered during the pandemic, they are seeing consumers return, but those people aren’t giving up their home exercise either. According to point-of-sale tracker The NPD Group, home exercise equipment sales are up 108% on a two-year basis. Gym traffic is up at chains like Planet Fitness and LA Fitness even as Peloton stock has surged over 440%. As CNBC points out, the pandemic has led to a number of fitness enthusiasts choosing a hybrid approach to working out, meaning both gyms and exercise equipment manufacturers may see gains.

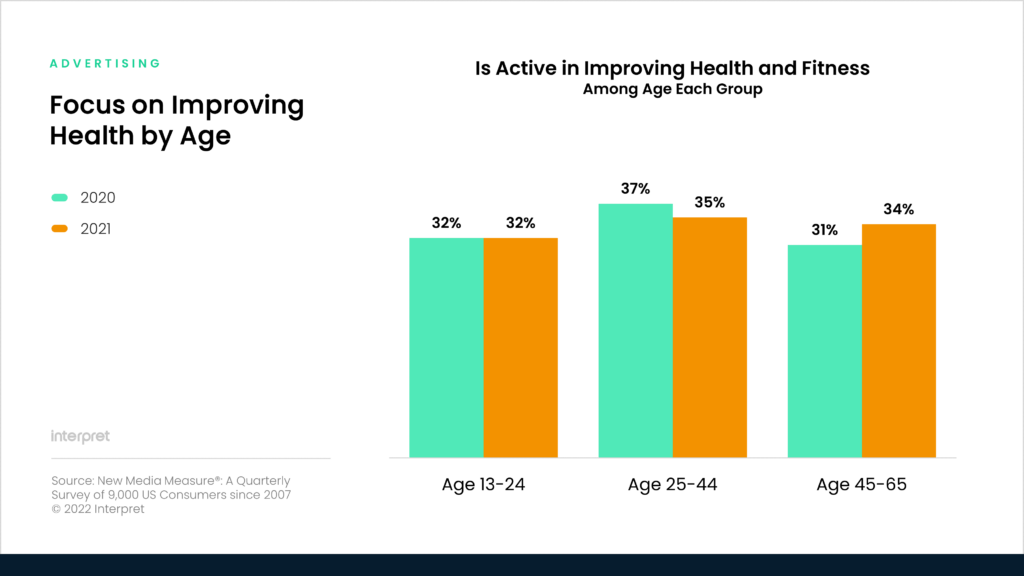

As brands navigate a third year of the pandemic, they should be mindful of the continued focus on health and fitness among a large portion of the population. According to Interpret’s New Media Measure®, older adults in the Gen X and Boomer generations are now catching up to Millennials in terms of health and fitness interest. The 45-65 age bracket has seen a three- percentage point gain in the last year whereas Millennials saw a slight decline (but remain ahead).