Back in the cathode ray tube (CRT) TV days and when the market was transitioning to far slimmer LCD screen technology, Sony was one of the leaders in the global TV business. In more recent years, however, the Japanese electronics firm has seen its market share shrink considerably in the face of stiff competition from the likes of Samsung, LG, Vizio, and others. While other electronics manufacturers have been able to attract new customers through a combination of quality and price, Sony’s been largely focused on the former, eschewing the idea of offering any “budget” TVs.

The 75-year-old company has been stressing its brand as a premium offering, and this trend is readily apparent with its new Bravia TV lineup revealed at CES 2021. As outlined by CNET, Sony’s new models include a 100-inch LCD and the biggest ever 4K OLED TV at 83 inches. Its new TVs will not only be brighter (always a challenge for OLED technology), but Sony is also leveraging a new AI that it is calling “cognitive” processing to augment the picture quality in areas on which the viewer is automatically more focused (such as faces).

Although pricing for the new lineup hasn’t been announced yet, the previous year’s models in the “Master” series retail for about $2,500 and $4,000 for the 65-inch and 77-inch sets, respectively. You can expect similar premium pricing for the new versions, which should suit gamers’ needs with full support for HDMI 2.1, 120 fps, and variable refresh rates.

Sony has also embraced Google TV as the backbone of its smart TVs while unveiling its entry into the high-end streaming market with a service that’s exclusive to Bravia owners called Bravia Core. This pre-installed streaming platform offers access to a variety of Sony Pictures films at a hefty 80 Mbps (3-4 times the data used by Netflix streaming), which is “near lossless” and should rival the picture quality of 4K Blu-ray discs.

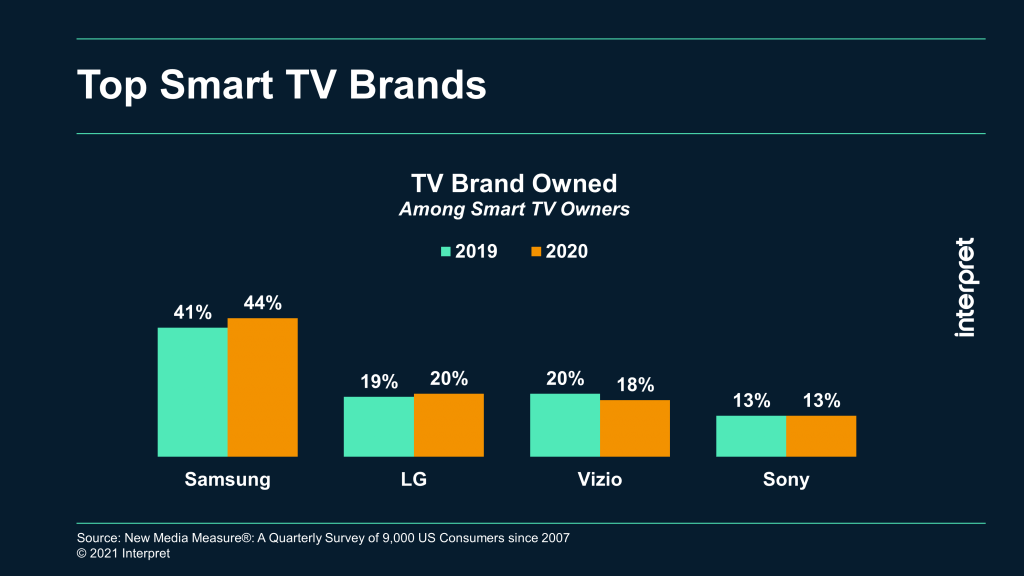

These moves all reinforce Sony as a premium brand for audio-video geeks and professionals in the AV space, but it’s unclear if these new models can really move the needle among mainstream consumers. The good news is that Interpret’s New Media Measure® shows that Sony’s smart TV market share did not decline any further in 2020, holding steady at 13% of US consumers, but the gap with Samsung and others is notable.