2021 was another difficult but successful year for the consumer electronics and smart home industries, as consumers maintained a “stay-at-home” lifestyle. The global pandemic continued to take a toll on many businesses, but consumers, spending more time entertaining themselves and working from home, continued to invest in products and services that enhanced that experience.

Smart home built-in

All of the top national homebuilders included smart home technologies in new housing offerings. D.R. Horton, Lennar, KB Homes, and others provided options in home offerings that include smart security systems, smart locks, doorbell cameras, smart thermostats, and other smart home amenities. More existing home sales are benefitting from smart home upgrades as more buyers look for a “move-in ready” home that includes smart technology. Multifamily rental housing and vacation properties continue their turn to proptech, using smart devices to differentiate housing offerings and to justify premium rents. Proptech vendors PointCentral, SmartRent, Stratis/RealPage, Entrata, Latch, and Dwelo are some of the leaders powering proptech across various types of rental and vacation properties. Enterprise property owners and managers are developing benchmarks for operational savings and net revenue increases that are validating their return on investment.

Landmark progress on communication standards

For years, standards battles have provided friction to development and adoption of smart devices, making products more expensive to develop and more confusing to consumers. With the major manufacturers united behind the Matter interoperability initiative—to be first introduced over Thread or Wi-Fi— all/most all significant device makers are now aligned with a standard that promises to ultimately give its device access to most other smart devices, eventually reducing customer confusion and increasing product value.

Low-cost products expand the category

Smart home devices continue to increase in functionality and ease-of-use, while costing less. Wyze, a company known for amazingly inexpensive products, continues to pump out new products that bring down the smart home category entry costs. Amazon partnered with Resideo in 2021 to develop a $60 smart thermostat, reducing price as an impediment to consumer uptake. Chamberlain offered its myQ retrofit smart garage door controller for $25 on Black Friday while introducing a completely redesigned premium garage door opener with an integrated camera. Offering lower cost products can be a “both/and” strategy and not necessarily an “either/or” brand position. Downward price pressure is making the smart home more affordable than ever.

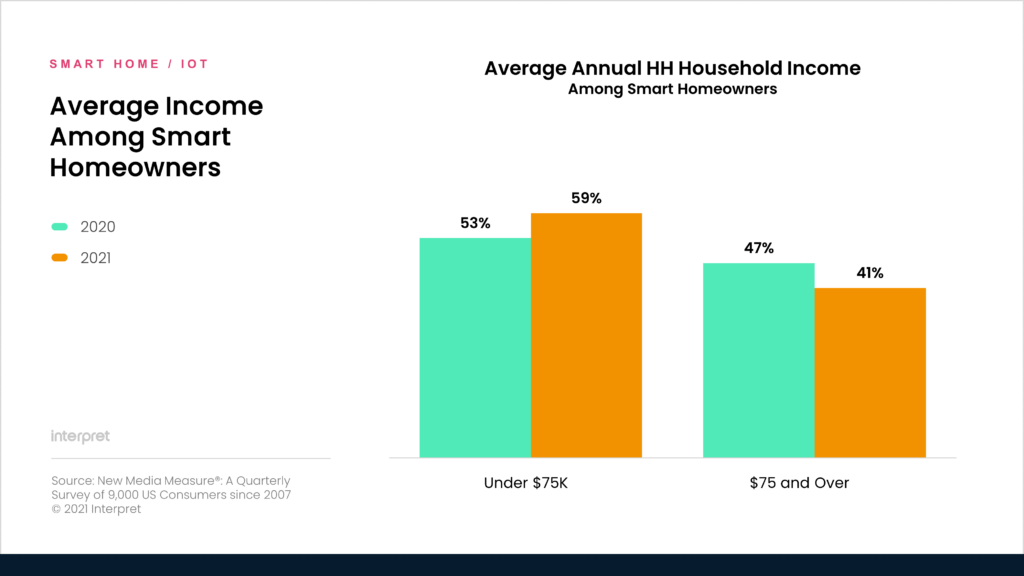

Smart products reach lower income buyers

Interpret’s consumer research of smart home product buyers indicates that those with lower median household income expanded ownership in 2021. In fact, 59% of 2021 buyers earn less than $75K. A combination of lower price points and increased awareness and utility of smart cameras, doorbell cameras, smart lighting, and other products has made them attractive options for lower income households, an important step in market penetration.

Cameras increasingly become center of security solutions

As homeowners and renters find increasing value from monitoring the front-porch, backyard, and driveway with inexpensive Wi-Fi cameras, consumer perception of security products is centered on video from a growing array of form factors. Video doorbells, outdoor cameras, flood light cameras, and portable indoor cameras are putting consumer eyes on every area of their property. Camera developers such as Arlo and Ring offer an emergency response feature to connect pro-monitoring stations to cameras, offering an inexpensive home-security system substitute that appeals to many buyers who previously could not justify the cost of professionally installed systems. For the self-monitoring crowd, app features for directly notifying local emergency services and data sharing features with first responders, such as RapidSOS, are increasing the emergency value of these camera systems.

Follow Interpret research in 2022 for the latest from its Smart Home Matrix™ suite of research products providing data and industry analysis of consumer behavior, market trends, and product forecasts.